Get Your Free Quote

Takes less than 60 seconds

Information verified with Medicare.gov

Medicare Approved

Licensed advisors

256-bit SSL

Bank-level security

BBB Accredited

A+ Rating

4.9/5 Stars

10,000+ reviews

Your Personalized Medicare Report

Get a comprehensive comparison of all available Medicare Supplement plans in your area. Our detailed reports make it easy to understand your options and find the perfect coverage.

Get Your Free Personalized Report Today

See exactly which plans are available in your area and how much you could save.

How It Works

Getting your perfect Medigap plan is simple and free

Sign Up

Enter your phone number and ZIP code to get started. It takes less than 60 seconds.

Compare Plans

Our licensed advisors help you compare all available Medigap plans in your area side-by-side.

Enroll

Choose your plan and we'll help you enroll directly with the insurance company. No fees, ever.

Why Choose Medigap Coverage?

Medicare Supplement Insurance (Medigap) helps cover what Original Medicare doesn't, giving you peace of mind and financial protection.

Visit Any Doctor or Hospital

See any doctor or specialist that accepts Medicare, anywhere in the United States. No network restrictions or referrals needed.

100% Coverage Available

Many plans cover 100% of Medicare Part A coinsurance and hospital costs, plus Part B coinsurance or copayments.

Foreign Travel Emergency

Most plans cover 80% of emergency medical care when traveling outside the U.S., up to plan limits.

Guaranteed Renewable

Your coverage can't be cancelled as long as you pay your premiums, regardless of health changes.

Coverage Starts Quickly

During open enrollment, coverage begins the first day of the month you turn 65 and are enrolled in Medicare Part B.

Automatic Claims Filing

Medicare-approved amounts are automatically sent to your Medigap insurer. No paperwork hassles.

Ready to Find Your Perfect Medigap Plan?

Our licensed advisors will help you compare all available options in your area.

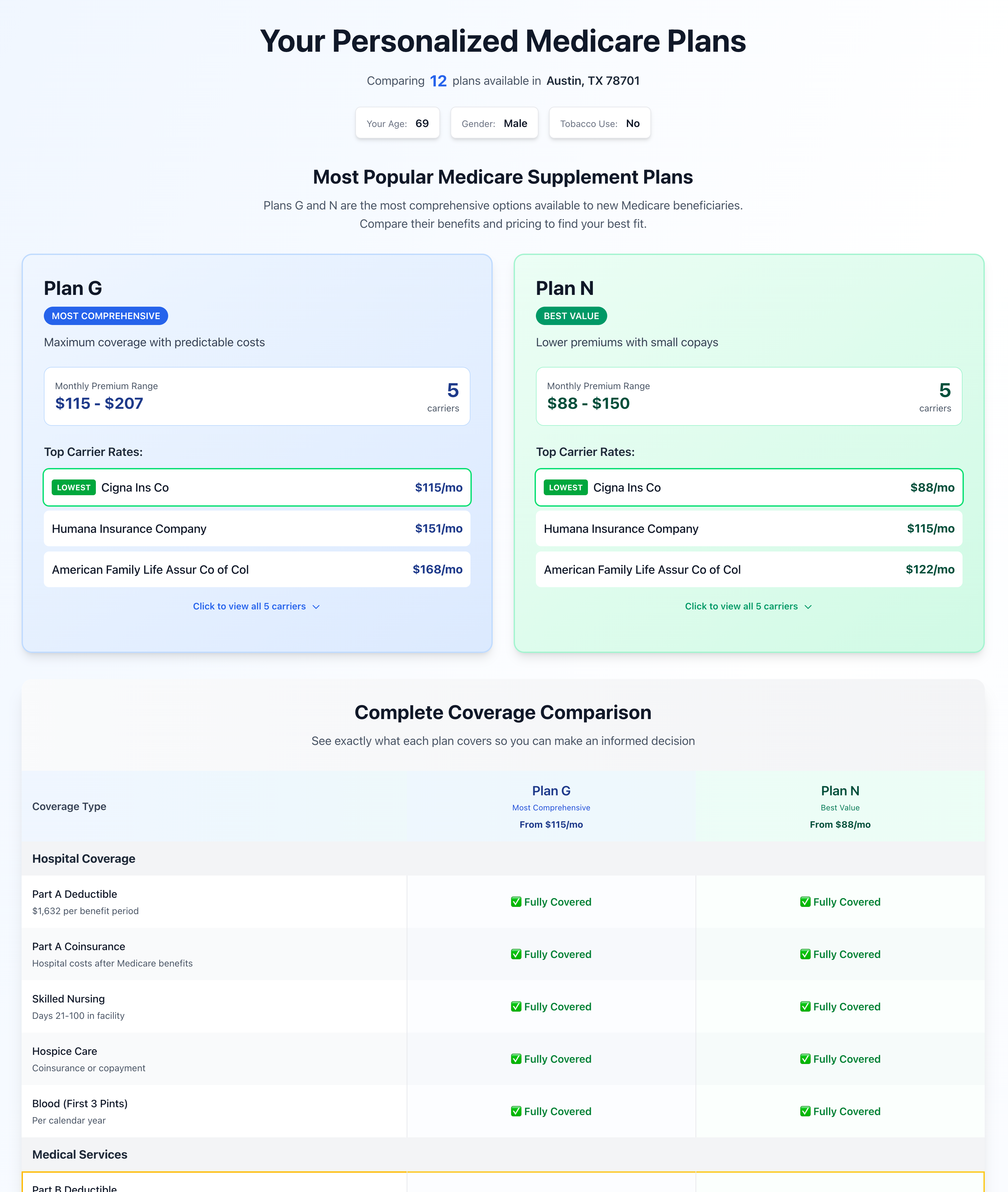

Popular Medigap Plans Compared

See what's covered by the most popular Medicare Supplement plans

Plan F

Plan G

Most PopularPlan N

| Benefits | Plan F | Plan G | Plan N |

|---|---|---|---|

| Part A Hospital Coinsurance | |||

| Part B Coinsurance | Copays may apply | ||

| Part B Deductible | |||

| Part B Excess Charges | |||

| Foreign Travel Emergency | 80% covered | 80% covered | 80% covered |

* Plan F is only available to those who became eligible for Medicare before January 1, 2020

Trusted by Thousands of Medicare Beneficiaries

Join over 50,000 seniors who found their perfect Medigap plan through our service

"The advisor was incredibly patient and explained everything clearly. I saved over $200 per month on my Medigap plan!"

"No pressure, just honest advice. They helped me understand all my options and choose the best plan for my needs."

"Switching to the recommended plan gave me better coverage at a lower cost. Wish I had done this sooner!"

"The enrollment process was seamless. My advisor handled everything and kept me informed every step of the way."

"As someone new to Medicare, I was overwhelmed. They made everything simple and found me great coverage."

"Free service, unbiased advice, and they actually answered their phone! Highly recommend to anyone on Medicare."

Frequently Asked Questions

Get answers to common questions about Medigap insurance

Medigap (Medicare Supplement Insurance) is health insurance sold by private companies to help pay for healthcare costs that Original Medicare doesn't cover, such as copayments, coinsurance, and deductibles. Some Medigap policies also cover services that Original Medicare doesn't cover, like medical care when you travel outside the U.S.

Learn more at Medicare.govThe best time to buy a Medigap policy is during your 6-month Medigap Open Enrollment Period. This period automatically starts the month you're 65 or older and enrolled in Medicare Part B. During this time, you can buy any Medigap policy sold in your state, even if you have health problems, without medical underwriting.

Learn more at Medicare.govMedigap premiums vary based on the plan type, insurance company, location, age, and other factors. Plans with more comprehensive coverage typically have higher premiums. Our advisors help you compare costs from multiple insurers to find the best value for your needs and budget.

During your Medigap Open Enrollment Period, insurance companies cannot deny you coverage or charge you more due to pre-existing conditions. Outside this period, insurers may use medical underwriting to decide whether to accept your application and how much to charge, unless you qualify for guaranteed issue rights.

Learn more at Medicare.govMedigap supplements Original Medicare and allows you to see any doctor that accepts Medicare nationwide. Medicare Advantage replaces Original Medicare and typically requires you to use network providers. Medigap generally offers more flexibility but may have higher premiums, while Medicare Advantage often has lower premiums but more restrictions.

Medigap plans sold after January 1, 2006, don't include prescription drug coverage. To get Medicare drug coverage, you'll need to join a separate Medicare Part D plan. Our advisors can help you find both Medigap and Part D plans that work well together.

Still have questions? Our licensed advisors are here to help.

Ready to Find Your Perfect Medigap Plan?

Join thousands of seniors who found better coverage at lower costs. Our licensed advisors are standing by to help.

No obligation • Free service • Licensed advisors